Abstract

Biomass gasification, a promising sustainable technology for decentralized electricity production, has the potential to displace fossil fuels while valorizing locally produced waste. Previous studies indicate that its technical and financial viabilities vary among projects, and few projects have been successfully developed, despite the sustainability benefits. This study identified and characterized the factors that influence the economic and environmental performances of such projects using a novel, hybrid method, with qualitative analysis using the Business Model Canvas and quantitative life-cycle costs (LCCs) considering the financial and external costs. The financial LCCs and external electricity generation costs were evaluated for business models in agro-industrial factories using proprietary residual biomasses and for those in isolated grids using local agricultural waste. The business models used for biomass gasification projects affect their LCCs and externalities more than factors such as their investment costs and energy efficiencies. The relationship between the business models, the financial performances of the projects, and their impacts on society are highlighted, showing that although projects using proprietary biomass waste have lower financial costs, off-grid projects generate more positive externalities, resulting in lower costs for society. These results indicate that policy support focused on appropriate business models may contribute to optimizing the use of financial incentives to foster investment in new sustainable technologies, contributing to the energy transition.

1. Introduction

Greenhouse gas (GHG) emissions that cause climate change are mostly caused by the fossil fuel combustion for electricity and heat production (24% of GHG emissions in 2019), agriculture, land use change, and forestry (22%) [1]. The energy transition, which aims at transforming how energy is produced and consumed, should include the development of decentralized energy production from local renewable sources, including unconventional fuels, such as waste [2,3,4]. Agricultural and forestry residues can generate environmental and health burdens if inappropriately managed [5] but can be used for energy production with the advantages of the carbon neutrality inherent to biomasses, without competing with alimentation [1]. Using carbonaceous feedstocks—coal, biomass, plastics, and municipal solid waste—the gasification process has two main products: a producer gas, the useful components of which are carbon monoxide (CO) and hydrogen (H2), and solid residues, mostly ash and some biochar [6,7]. Gasification is well suited for small-scale, decentralized electricity production in rural areas with available residual biomasses [8,9,10,11,12], with environmental and socioeconomic advantages, such as better air quality, lower GHG emissions, less dependence on the fossil fuel supply and price fluctuations, and additional revenues for farmers from the sale of crop residues [13,14,15,16,17]. However, even though the levelized costs of electricity (LCOEs) of biomass gasification may be lower than the diesel-based LCOEs, diesel gensets are still the most common technology for rural electrification, mostly due to their lower investment costs [18,19]. Uncertainties about the biomass residue supply, technology adaptation, and the local technical competence for operation add to the barriers to such projects [20]. The current investment decision-making practices favor solutions with lower investment costs, proven technologies, and established markets [21]. Externalities, especially when borne by low-income rural populations, are seldom considered by private investors without appropriate regulations or incentives [22]. Generally, policy and financial incentives for energy production from residual biomasses are justified by the positive externalities generated both by fossil fuel replacement and waste valorization [16].

The analytical framework of the business model, developed in the 1990s, is based on the concept of the value created, delivered, and captured by an organization [23]. The adoption of new technologies depends on the development of adequate business models that can foster investment [24,25]. Following the momentum for integrating sustainability into investment and business decision making, the Sustainable Business Model concept appeared within the business model literature [26,27].

The main objective of this study is to investigate the impacts of different business models for decentralized electricity production from the small-scale gasification of residual biomass in terms of the financial and external life-cycle costs, identifying and characterizing the factors that influence the economic and environmental performances of such projects, and well as additional, non-financial barriers. The underlying motivation is to develop a methodology that allows for identifying which business models have the lowest societal costs but are subject to barriers, contributing to optimizing the use of policies and financial incentives to foster investment in sustainable technologies in the energy sector. The methodology adopted, using both qualitative analyses based on the Business Model Canvas analytical framework and quantitative life-cycle cost (LCC) modeling considering the financial and external costs for society, was developed and tested to demonstrate the importance of the business models in determining both the economics of a project and the externalities borne by its stakeholders.

Brazil, a country with important agricultural and forestry activity, a high occurrence of decentralized electricity consumption, strong dependence on diesel-based electricity generation in isolated areas, and waste management issues, was used for illustrative case studies.

Therefore, this article contributes to the current literature not only by providing new evaluations of the economic viability of residual biomass gasification for small-scale electricity production in the Brazilian context, but also by suggesting a novel, hybrid methodology to demonstrate the importance of the business models for the sustainability of an electricity production technology, with both qualitative and quantitative results. To the best of our knowledge, such an approach has not been presented before and can contribute to fostering the development of a more sustainable electricity sector.

This article is composed of six sections. A literature review follows this introduction. The third section details the methods used to describe the business models used in the case studies and evaluate their life-cycle costs, environmental impacts, and external costs. The results are presented in the fourth section, before the discussion and conclusion.

2. Materials and Methods

2.1. Literature Review

2.1.1. Economic Assessment of Small-Scale Biomass Gasification for Electricity Generation

The economic viability of small-scale biomass gasification for electricity production is the subject of a limited but currently growing number of scientific papers.

Most case studies were developed in countries with a large agricultural activities, such as India, Indonesia, Pakistan, the United States of America, the Netherlands, and Japan, amidst the interest in alternatives to fossil fuel-based electricity production and waste valorization, in the context of the growing electricity demand and rural electrification efforts. A selection of 30 papers published between 1997 and 2023 by authors whose main objective was to assess the economic viability of small-scale waste biomass gasification for electricity production show the following trends [8,9,16,18,28,29,30,31,32,33,34,35,36,37,38,39,40,41,42,43,44,45,46,47,48,49,50,51,52,53,54].

Many papers on the economic viability of small-scale electricity generation from residual biomass gasification indicate the strong dependency of the economic viabilities of projects on financial incentives, such as subsidized tariffs or capital subsidies, and on the biomass costs [16,32,37,42,49].

The evaluations of economic viability are usually based directly or indirectly on the comparison between the electricity production costs and business-as-usual (BaU) costs or electricity tariffs. Challenges to the economic viability of small-scale waste gasification projects include high investment and operational costs (these are mostly driven by human resource costs) [54].

Most of the reviewed papers considered the production of electricity by syngas-fed Internal Combustion Engines (ICEs) or gas engines. The integration of biomass gasification with fuel cells, especially solid oxide fuel cells (SOFCs), is presented in [55] as a promising although still experimental technological option for electricity production at a small scale because of its high efficiency and fuel flexibility. However, the development stage has not reached commercialization yet; therefore, investment costs are still very high, and some technical barriers are still being addressed by research. It is expected to have positive environmental outcomes [56].

Only one of the papers integrated externalities in the scope of its analysis: You et al. [18] assessed GHG emission reductions but did not account for this externality in the evaluation. Other articles offer parallel assessments of the economic and environmental aspects [40,41,57]. Gojiya et al. [38] evaluated the economic value of nutrients lost from the residue and compared them to the revenues obtained by the gasification of this residue.

Most articles consider a unique business model, generally without discussing this topic, with a few exceptions. Eslner et al. [9] compared the Net Present Values (NPVs) of the biomass gasification of wood and sewage sludge mixes under two different business models. According to Dowaki et al. [16], research developed at the beginning of the 2000s on the economic feasibility of biomass gasification in Japan was motivated by its potential environmental benefits, despite the high investment costs. The findings of this work concluded that small-scale systems are more costly than large-scale systems operated by Independent Power Producers (IPPs). However, depending on the waste-processing fee applicable to wooden residues in sawmills and local electricity tariffs, small-scale systems could become competitive as captive power generation with the sale of excess electricity to the grid. You et al. [18] studied the feasibility of decentralized gasification systems in Indonesia and compared the financial performances of systems using palm oil-processing residues to produce electricity to supply either the palm mill consumption or nearby villages through a mini-grid. Factors such as economies of scale, the possibility of selling extra electricity, and the mini-grid investment costs largely favor the captive power generation in the mill over the mini-grid option. Naqvi et al. [42] also compared the outcomes of different business models for off-grid electricity generation from biomass gasification.

Pode et al. (2015) and Pode et al. (2016) [33,36] suggested adequate business models to reach the economic sustainability of rice husk gasification for electricity generation without subsidies, supplying off-grid consumers, although without comparing different business models.

2.1.2. Barriers and Challenges to Small-Scale Biomass Gasification

Although small-scale biomass gasification using downdraft fixed-bed gasifiers is widely reported as a viable technology for electricity production, with positive economic, social, and environmental outcomes, a relatively small number of projects have been implemented. The literature on biomass gasification has documented the barriers that explain this situation, starting with technical barriers.

According to Gosch et al. [58], although wood gasification technology is already quite mature, further research is needed to adapt it to other types of biomasses (also reported by Littlejohns et al. [59]) and in terms of the syngas quality, cleanup techniques, and adaptation of engines to low-quality gas. Biomass gasification is currently still considered not fully mature, complex, and suffering from a lack of research [17,20]. Ruiz et al. [60] reported the formation of tars in syngas and the development of cost-effective solutions to clean it as one of the major challenges to the commercial deployment of gasification, as have other studies [9,42,61,62]. Rahman et al. [63] raised the issue of the gasifier’s operation safety, highlighting the risks of fire, explosion, toxic emissions, and the corrosion of the reactor, all related to the high operating temperatures and the nature of the gases produced. Safety systems must be installed, and strict operational procedures must be implemented, to reduce hazards. Reductions in local technical capacities are cited as a barrier to the efficient operations of projects [54,64]. The low manufacturing capabilities of gasifier manufacturers and the low competition due to the relatively small market limit the deployment of the technology, which also lacks certification, standards, and patents. These aspects also contribute to limiting economies of scale [65].

This last point contributes to financial barriers, with high investment costs reported by Bhattacharyya [32] and Teixeira Coelho et al. [54]. Access to finance, a related challenge, is potentialized by the high perceived risks related to technological uncertainties and the low creditworthiness of consumers. Projects therefore remain dependent on government incentives and subsidies [20,32,66]. Operational aspects, such as biomass seasonality and irregular demand, lead to the underuse of the capacity, negatively affecting the economic viability.

Market barriers are mostly related to the challenges of biomass procurement uncertainties and price fluctuations due to the non-existence of a structured market [17,64], and they are strongly linked to institutional aspects. For example, biomass suppliers’ involvement in projects is considered necessary to mitigate the market barriers [20]. Gosch et al. [58] pointed out that better institutional mechanisms are needed to stimulate stakeholder interactions and information, even in applications in which gasifier deployment is commercially attractive.

Policy barriers are also mentioned by many authors as holding back biomass gasification development. Gosch et al. [58] explain that these are the result of a lack of awareness among policymakers, whereas Teixeira Coelho et al. [54] considered the lack of political will. These barriers consist mostly in the absence of adapted regulations or incentive programs [20,32,42,54,58,62]. Interfaces of incentive programs for gasification with other relevant policies, such as rural development and electrification, are also reportedly limited [66].

Policy is, however, appointed as the most needed solution to the other barriers, mostly through the diffusion of information and awareness raising among stakeholders, thereby creating institutional conditions for the development of the market, incentives for research and development and pilot projects, training programs, and further financial incentives, such as loans and tax rebates [66]. Policy and regulation are also enablers of adequate business models, which are needed to deliver better economic performances, increase access to finance, and help solve institutional barriers by engaging stakeholders [32,36,58,67].

2.1.3. Sustainable Business Models

The concept of Sustainable Business Models derives from the business model concept, following the sustainability concerns that have been building up over the last decades.

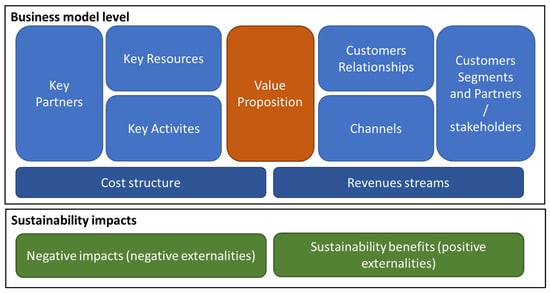

The analytical framework of the business model (BM), developed in the 1990s, is based on the concept of the value created, delivered, and captured by an organization [23]. These processes are described by the method of the Business Model Canvas, consisting of nine “blocks” specifying how the organization creates value (through its main activities, resources, and partnerships), to whom, how it delivers it (through customer relations, logistics channels, and client and partner segments), and, finally, how it captures it (through sources of income and costs) [68]. In the mainstream context, the value captured by an organization through a BM is mostly economic [69].

In the context of sustainable development, technological innovations with positive environmental and social impacts have appeared, but, according to Lüdeke-Freund [69], they must turn into successful businesses to effectively deliver these impacts, which can be an uncertain challenge for sustainability entrepreneurs. Case studies on energy service companies [70], distributed electricity generation by solar photovoltaic systems [71], and renewable energy microgrids [72] have shown the importance of adequate BMs to foster investment in innovative, sustainable ventures in the energy sector. In the last case, the authors raise the example of the need to develop new relations between users and companies, including new pricing mechanisms.

To assist with the process of developing BMs that allow sustainable innovations to flourish, also denominated Sustainable Business Models (SBMs), research has looked at novel ways to analyze and compare BMs for such innovations [73]. The process of developing new BMs or transforming BMs to turn them into more sustainable ones is often embedded in the concept of BM innovation (BMI) [73]. Donner and de Vries [74], while studying BMI in the context of the agri-food sector, mention the importance of the institutional environment (market and legal, mostly) and new stakeholders in different sectors, among which new synergies and cooperation are created.

Frameworks to describe and analyze SBMs have been developed, aiming at including external costs and benefits in the analysis of the value created by a given activity, by considering its social and environmental impacts, and including a wider range of stakeholders than the classical business model approach [26,27]. The concept of Sustainable Value has been discussed as “a term encompassing the environmental, social, and economic benefits of a given model” [69], which is evaluated using the framework suggested by the authors, through stakeholders’ activities, with positive and negative values.

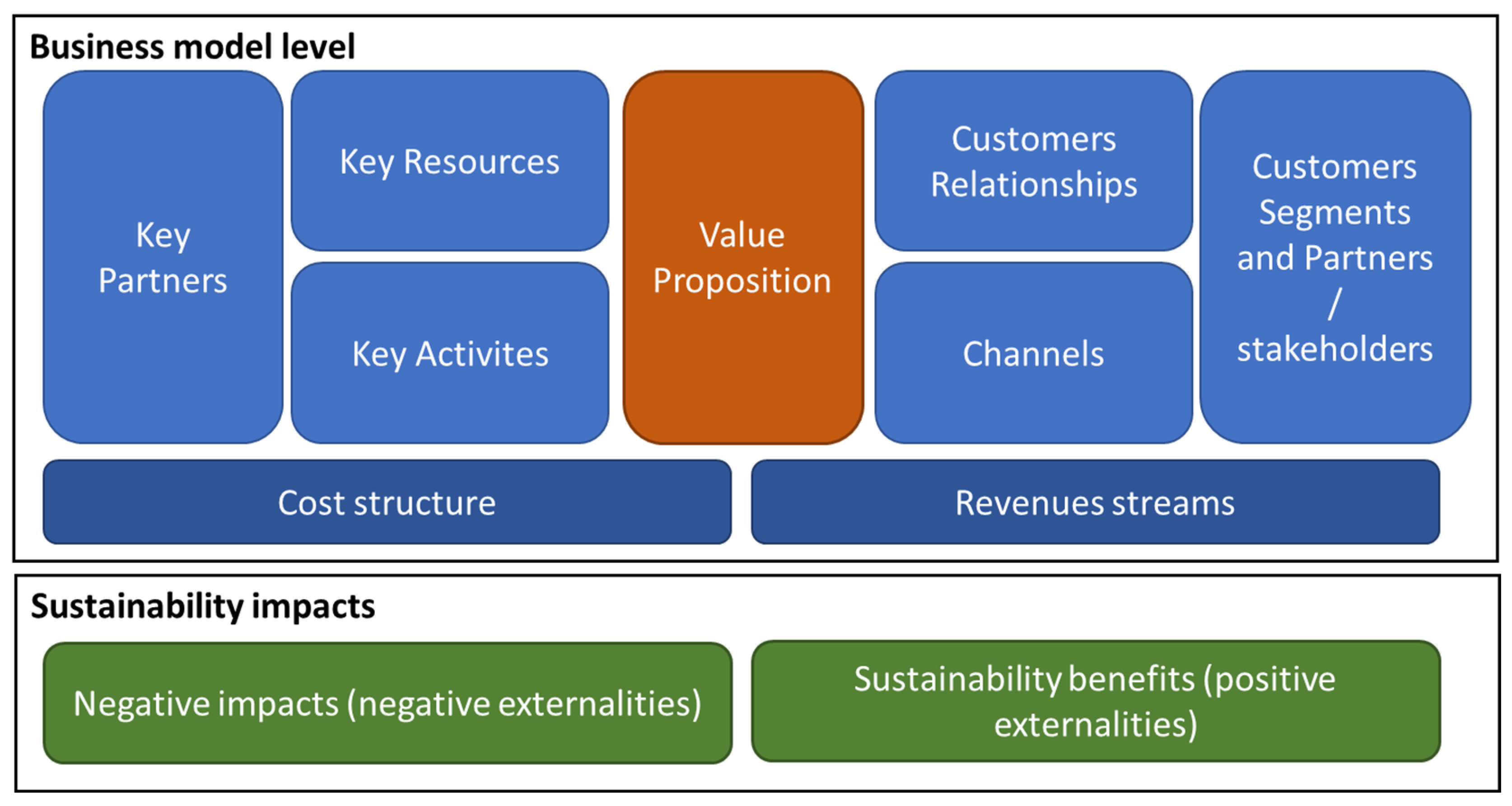

The existing qualitative frameworks include the extended Business Model Canvas presented by Boons and Lüdeke-Freund [25], in which the resources, activities, products, and other elements support the evaluation of the costs and revenues of a project and its financial indicators, as well as its environmental impacts and external costs. The SBM framework proposed by Otoo et al. [27] includes two additional blocks relative to positive and negative externalities. Figure 1 describes this Sustainable BM Canvas.

Figure 1.

Business Model Canvas for sustainability. Adapted from Antikainen and Valkokari [26].

The BM-LCA, presented by Goffetti et al. [75], is described as the first framework with both qualitative and quantitative information about SBM contributions to sustainability.

Drechsel et al. [76], while discussing the BM concept in the circular economy context, observed that environmental and social costs due to inadequate waste management tend to be externalized, and few market incentives exist to reduce waste disposal. However, waste valorization, especially agricultural waste, allows for capturing value through nutrients and energy recuperation and avoids transport to landfills and the handling costs involved. Generally, the authors point out a lack of understanding about the value generated by waste valorization activities compared to BaU practices, such as burning, dumping, and landfilling. Internalizing externalities, especially to human health and the environment, could justify subsidies to incentivize technologies such as waste valorization, generating positive environmental and social outcomes.

2.1.4. Life-Cycle Costs, LCOEs, and External Costs

Life-cycle costing was developed as a tool to systematically evaluate and compare the costs of products or systems over their whole life cycles, as opposed to simply considering the investment costs. It is supposed to include operational costs and end-of-life costs if borne by investors, who can also be the consumers of a product [77].

The LCOE is a widely used metric to calculate the life-cycle costs (LCCs) of electricity production. It is defined as the final price of electricity required to break even with the project’s total costs over its lifetime. It sums the present value of the costs incurred during the system’s lifetime, divided by the quantity of electricity produced [78].

Externalities, defined as “benefits or costs that are generated as by-products of an economic activity” not supported by the actors involved in this activity, can be incorporated into the LCC and LCOE to reflect the costs generated by electricity production to other stakeholders or to society more generally, which is not usually integrated into the financial cost structure [79,80,81]. The Societal LCC includes all the costs borne by society associated with the life cycle of a product, including the environmental and social impacts, which do not generate actual direct monetary costs [77].

However, the valuation of external costs due to air and water emissions and solid residues is subject to methodological challenges due to the complexity of externality pricing [79,82].

The benefits of decentralized electricity generation in the context of an interconnected system, whether by small IPPs or prosumers, have still to be fully appreciated [4,83]. Benefits include the efficient use of local resources, lower investment burdens on national grids, savings on transmission losses, and the redistribution of rent from large utilities to smaller companies and prosumers [4]. If adequate market mechanisms are implemented, decentralized generation close to the demand can contribute to solving issues on the grid by supplying local flexibility services, reducing balancing costs, and deferring network reinforcement costs. Market mechanisms that allow decentralized electricity generation actors and prosumers to capture the financial value of these benefits can facilitate the development of innovative business models and increase the investment in this type of technology [83]. However, the high penetration of decentralized electricity production may also affect the system frequency and induce local voltage instability and power flows from low- to medium-voltage grids, creating the need for grid protection systems [84].

The hypothesis of this work is, therefore, that adequate business models for small-scale electricity generation from residual biomass gasification are key to fostering the development of this technology. Indeed, business models have a strong effect not only on the financial outcomes of a project, but also on the value created for society and the response that a firm can develop to the financial, technical, and market barriers by structuring its relationships with suppliers, clients, and other stakeholders, optimizing its asset use and cost and revenue structure. A structured methodology highlighting both the financial and external costs of this technology within different business models can contribute to policy formulation and direct subsidies into the configurations most beneficial to society. Outcomes are evaluated quantitatively by incorporating externality costs into the calculation of the LCCs for different BMs applied to the same technical setting, and qualitatively through the relation between the barriers identified in the literature review and the elements of the BM Canvas of both case studies. This study presents the methodology and its application to the Brazilian context.

2.2. Methods

The following methodology was elaborated to test the hypothesis of this study.

First, a tool (LCC tool.xls in Supplementary Materials) was built to calculate the Financial LCCs, LCOEs, and Societal LCCs of small-scale electricity generation systems from biomass gasification, and to conduct a sensitivity analysis of the results. Using Microsoft Excel (Version 2403 Build 16.0.17425.20176) and following the discounted cash flow method, this tool calculates the different LCCs in a simple and easy-to-adapt way. The Financial LCC reflects the technological costs from the point of view of investors, the LCOE represents the actual costs for investors after subsidies are applied, and the Societal LCC integrates external costs, thereby reflecting the relevant impacts for society in the monetary dimension.

Case studies were then qualitatively described using the Sustainable BM Canvas, according to the regulatory regimes applicable to small-scale decentralized electricity generation in Brazil. This step set the qualitative aspects of the BMs and allowed for their structure comparison; these aspects were later translated into the quantitative tool.

Secondary data were collected from the literature revision to quantify the inputs, outputs, and externalities of typical biomass gasification with small-scale electricity generation. Data were selected from studies on residual agricultural biomass gasification, with electricity production capacities of up to 1 MW, and the variations in the data between or within studies were registered for the sensitivity analysis.

Finally, the parameters affecting the models’ performances, internal costs, and externalities were identified for the sensitivity analysis to identify those most relevant to the variation in the different LCCs studied.

2.2.1. Elaboration of Tool to Calculate LCOE and Externalities of Small-Scale Electricity Generation from Biomass Gasification

A financial model was developed using Microsoft Excel to calculate the life-cycle costs according to the LCOE formula, as well as the GHG emissions and external costs of electricity production in both business models and diesel generation in isolated grids.

The LCOE formula is presented in the following equation, according to Larsson et al. [78]:

where INV is the investment cost; i is the reference year; N is the number of years of operation; OPCosts are the operational costs (operation, manutention, and repairs); FuelCosts are the costs of securing fuel (biomass in the present study); FinCosts are the costs of the debt and interests servicing other end-of-life costs; d is the discount rate; and Ei is the net electricity produced in the reference year (i).

Three different costs were calculated based on the same formula. The Financial LCC considered only the direct costs and revenues of the projects; the actual LCOE included eventual subsidies as negative costs in the “Others” category; and the Societal LCC further included external costs in this category.

External costs were counted as negative if they represented benefits or avoided costs for society in comparison with the BaU alternative of the project.

GHG emissions were valued at the expected market prices for carbon credits. Other externalities, such as air and water pollution due to the gasification process, syngas cleaning, and electricity production emissions, are very similar in the two business models studied and still subject to high uncertainties, and their economic valuations are subject to methodological challenges; therefore, they were excluded from this study. External-cost accounting for inadequate solid-residue disposal was considered in the Societal LCC, which is supposed to be equal to the cost of the disposal of solid waste in an appropriate landfill, according to the valuation method of avoided control costs [85].

Considering the high variability observed in the literature in terms of both the net electricity yields and the externalities of small-scale biomass residue gasification, as well as variations in the costs and parameters used for the processes, sensitivity analysis was required to identify the most relevant parameters and their relative impacts on the results. The sensitivity analysis compared the impact on the Financial LCC, LCOE, and Societal LCC of the factors contributing to the most relevant shares of the LCCs. Variations of ±10% and ±20% were implemented in the model for the selected factors. Considering the relevance of GHG emission reduction and the current trends in emission pricing, an additional sensitivity aimed at identifying the GHG emission price that would equate to the LCOEs of both models, if internalized.

2.2.2. Definition of the Case Studies

Business models for electricity production must follow the regulatory regimes allowed in the jurisdiction where it is implemented [86]. In the case of Brazil, the two main regulatory frameworks for small-scale decentralized electricity production are the grid-connected distributed generation (DG) and the off-grid (OG) supply, generating two corresponding types of business models.

Under the DG regulatory regime, consumers may install renewable-energy-based electricity generation systems at a capacity limited to their electricity demand, up to 5000 kilowatts (kW). The owners of such systems may not sell electricity but can use it directly for their consumption, or they can inject it into the grid when it is not needed, generating credits to compensate for the electricity consumed from the grid when the system is not producing [87].

In the OG model, electricity is produced by IPPs with Power Purchase Agreements (PPAs) with distribution concessionaries (DCs) awarded through bidding processes. The BaU is diesel-based generation, but biomass-based and other renewable energies are allowed to participate [88].

Both models present wide ranges in terms of the electricity production capacities: according to the EPE 2023 planning for isolated grids in Brazil (https://www.epe.gov.br/sites-pt/publicacoes-dados-abertos/publicacoes/PublicacoesArquivos/publicacao-713/Apendice%20III_r0.xlsx, access date 1 February 2024), their installed capacities vary between 2 and 31,250 kW, with half of the grids presenting capacities below 1500 kW, and a quarter presenting capacities below 250 kW. Agro-industries and wood-processing plants also vary widely in terms of scale, with corresponding variations in the electricity demands. According to the ANEEL database (https://app.powerbi.com/view?r=eyJrIjoiY2VmMmUwN2QtYWFiOS00ZDE3LWI3NDMtZDk0NGI4MGU2NTkxIiwidCI6IjQwZDZmOWI4LWVjYTctNDZhMi05MmQ0LWVhNGU5YzAxNzBlMSIsImMiOjR9, access date 1 February2024), most rural DG systems using biomass generation have capacities lower than 800 kW, with half of them below 140 kW.

Among isolated grids between 250 and 800 kW, the load factor varies between 45% and 64%.

Therefore, this study considered a technical setup able to deliver 460 kW of net electrical power, based on a gasification system commercialized in Brazil by the company W2E Bioenergia under the name “Pyroflex 500”. The literature review showed that among the various gasifier designs and electricity generation technologies, the best-suited setup for small-scale biomass gasification and electricity production is a fixed-bed downdraft gasifier and an ICE, with a syngas-cleaning system consisting of condensers and a purification tower. Most commercialized reactors are fed with woody biomass, which is widely available as a residue in grid-connected and isolated areas in Brazil. Other possible biomasses, subject to published studies, include açaí kernels [28,89] and rice husks [32,33,34,35,36], among other widely available biomasses in Brazil.

The DG system is supposed to operate at an average load of 95% for 11 h daily (Ei = 1755 MWh yearly), supporting the operations of the factory, whereas the OG system operates for 24 h at an average load of 45% (Ei = 1813 MWh yearly).

The analytical framework of the Business Model Canvas, together with the two additional blocks proposed by Otoo et al. [27] to constitute the extended BM framework, is used for the qualitative description of the models. This description highlights the main differences between the two cases studied in terms of their costs, source of revenues, efficiencies, emissions, resources used, and externalities, with the main results presented in Table 1 below.

Table 1.

Qualitative descriptions of business models.

Relevant differences can be identified in all the elements of the Business Model Canvas, leading to not only different cost and revenue structures but also qualitative challenges related to operation and maintenance.

2.2.3. Data Collection, System Dimensioning, and Financial Assumptions

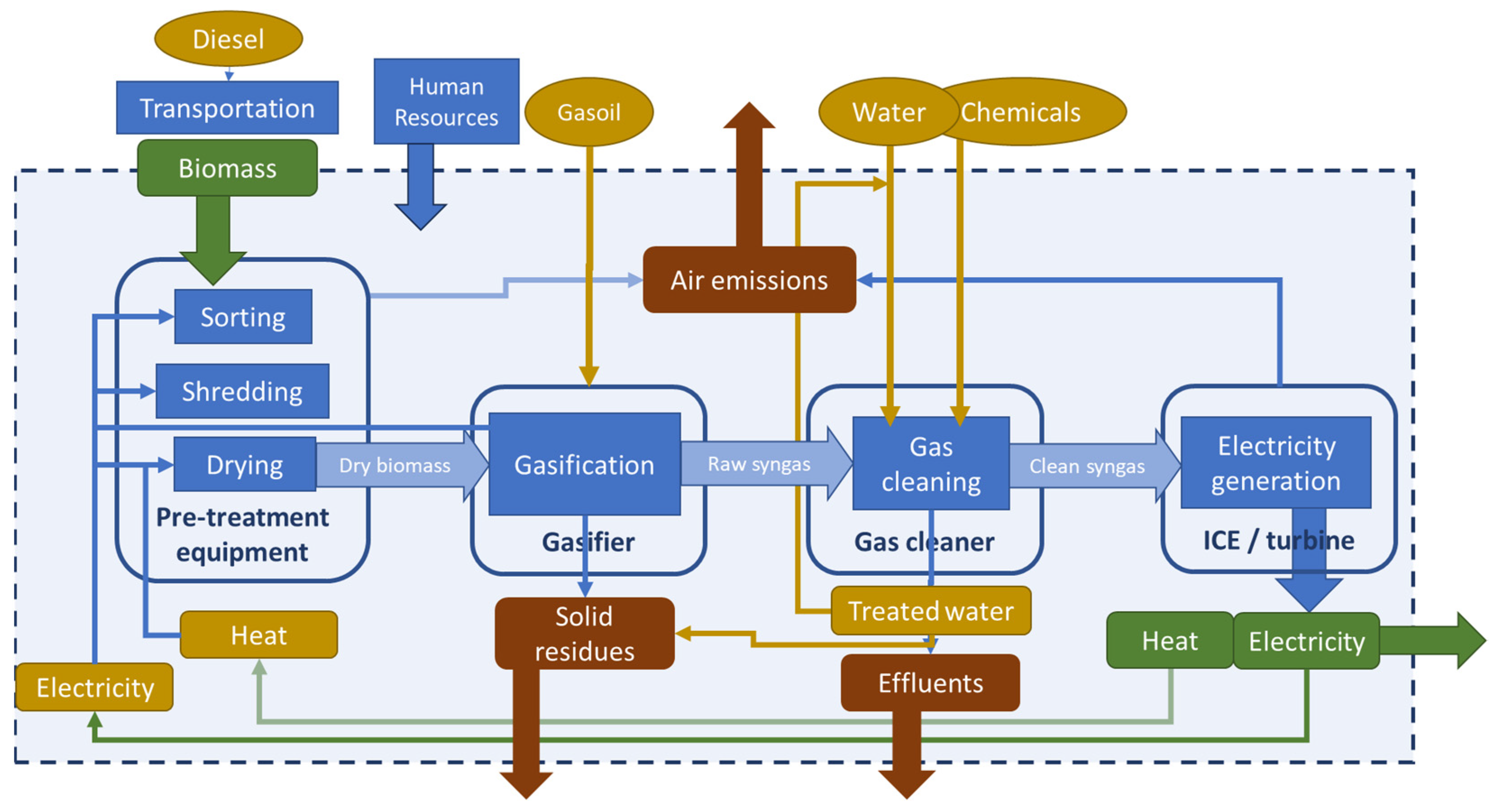

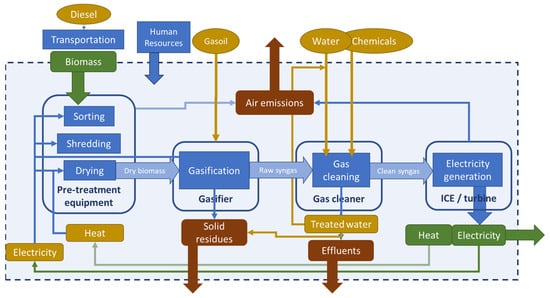

The collection of data for the LCC calculations was guided by flowcharts of the inputs and outputs presented in the following figures: Figure 2 presents the detailed flowchart of the technical system, common to both case studies, and Figure 3 presents the differences in the inputs and outputs between the two case studies.

Figure 2.

Flowchart of inputs and outputs of biomass gasification with electricity generation processes (authors’ elaboration). The boundaries of the system are represented by the dotted line. Note that in the case of the DG model, biomass is generated internally, while, in the OG model, it is sourced outside of the system, with the need for transportation to the system (authors’ elaboration).

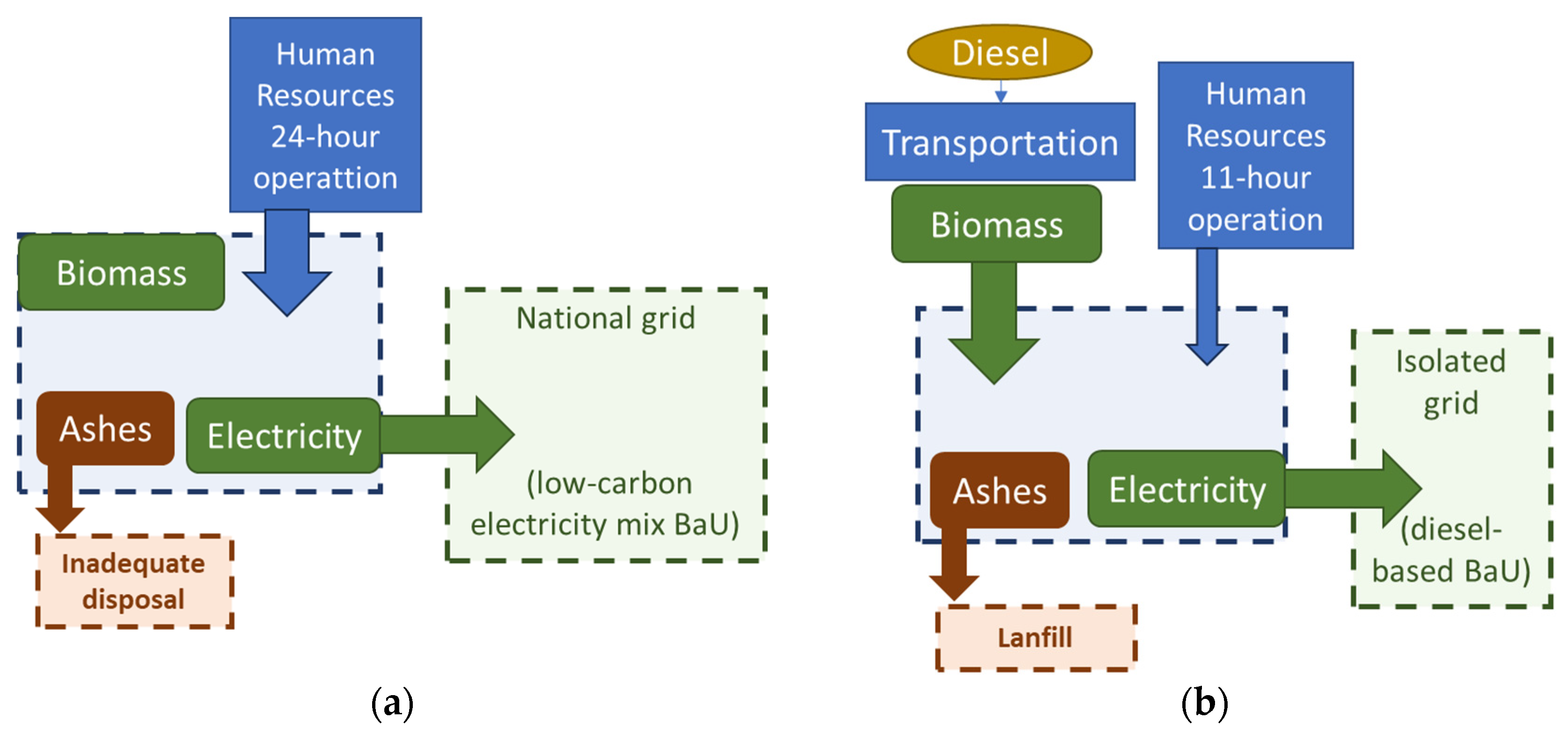

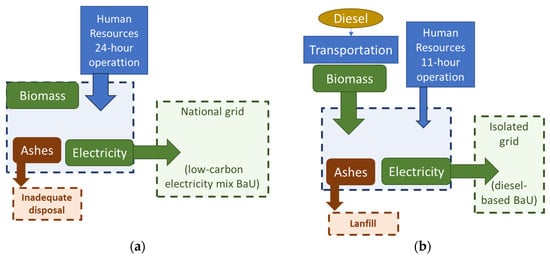

Figure 3.

Comparison of inputs and outputs of the technical system in both case studies: (a) distributed generation (DG) business model; (b) off-grid (OG) business model. The blue rectangle delimited by a dotted line represents the system presented in Figure 2 (authors’ elaboration).

A selection of papers from the literature review, based on small-scale fixed-bed downdraft gasification systems with ICEs, technically similar to the solution selected for this study, provided the necessary data for the calculations. As mentioned earlier, wood residues are considered the default feedstock, but the model works regardless of the type of biomass, with the possibility of adjusting the overall system efficiency, moisture content, and biomass LHV. Table 2 below presents the relevant data collected from the literature review and used in the modeling.

Table 2.

Relevant data were collected from the literature review.

Table A1, Table A2 and Table A3 in Appendix A describe, respectively, the investment costs (INV, also denominated CAPEX), operational (OPEX, including FuelCosts and OPCosts) costs, and the details of the GHG emission reduction calculations.

The equipment is assumed to be identical in both models, following high quality and safety standards, and is able to deliver stable power to the grid when applicable. It is also assumed that adequate operational procedures and a strict maintenance schedule are followed to minimize the risks of accidents and unplanned downtime. The main difference between the CAPEX and OPEX values are the equipment transportation costs (the OG model is installed in a more remote locality); the higher administrative costs in the OG model due to the regulatory procedures for the bidding process and compliance with regulatory requirements (affecting both the CAPEX and OPEX); the necessity for biomass transportation in the OG model, not observed in the DG model, which generates additional operational costs and GHG emissions, directly related to the transportation distance; and landfilling fees, which are considered only in the DG model.

The externality evaluation focused on the GHG emissions and the avoided costs for society, listed in the category “Others” in the LCOE calculation. The avoided costs for society were mostly due to the lower subsidies needed in the OG model compared to BaU, diesel-based generation. External costs were also considered in the OG model because of the lack of adequate landfills for the solid residues of the process. Other environmental externalities, such as air emissions, were not included in the calculation because they are almost identical for both models and subject to very high uncertainties, both in terms of the quantities emitted and the external costs for society [18,40,95,96,99,104,105,106].

The GHG emissions considered were (i) biomass transportation by trucks fueled by diesel in the OG model; (ii) the avoided GHG emissions from the electricity substituted; (iii) the avoided biomass transportation in the DG model; and (iv) the overall gasification and syngas use for electricity generation. This process is assumed to be almost carbon-neutral, due to the use of residual biomass [18,41]. However, some methane emissions during the gasification process, as well as those due to the treatment of water used for syngas cleaning and the construction of the power plant, were considered in this study, following [41].

To compensate for the high costs of generation in the isolated grids due to the costs of diesel importation and logistics, cross-subsidies are levied on consumers from the national grid and transferred to the DC, which operates isolated grids [88]. This subsidy is equal to the difference between the price of the electricity sold by the producers in the isolated grid and the average price in the interconnected grid, and it is strongly dependent on the diesel price for isolated-grid generators. The initial price, relative to 2024, was evaluated at BRL 6.32 per liter, according to the EPE’s projections for the Amazonas, Pará, and Roraima states [107]. To incentivize biomass-based generation, this subsidy was extended to the electricity produced from renewable sources. Additionally, renewable-based producers are entitled to a subsidy paid during operation, equal to the difference between their costs and the diesel-based generation costs, adding up to the maximum of the amount of their CAPEX values [108].

A loan of the amount of 60% of the CAPEX was considered, following the BNDES (Brazil National Development Bank) conditions for the interest rate (10% overall), tenor (12 years), and amortization (constant) (https://www.bndes.gov.br/wps/portal/site/home/financiamento/guia/guia-do-financiamento/ access date 1 February 2024). A discount rate (d) of 8% was considered, as adopted by the EPE in electricity-sector-planning studies [109], with 15 years of operation. The number of years of operations N was assumed to be 15.

3. Results

3.1. Life-Cycle Costs of Electricity Production

This section presents, for both BMs for biomass gasification and diesel-based generation in isolated grids, the Financial LCC, which includes all the direct costs incurred by the project’s owners; the LCOE, obtained after including subsidies in the LCC calculation; and the Societal LCC, which integrates the costs for society, including the realized or avoided subsidies and environmental costs. Carbon credits are not currently awarded to small-scale biomass projects in Brazil; therefore, GHG emission costs were considered external costs and included in the Societal LCC. The results are summarized in Table 3 below.

Table 3.

Financial LCC, LCOE, and Societal LCC of the DG and OG models compared with diesel-based, off-grid electricity generation.

The Financial LCC and LCOE of the DG model are equal because no subsidy is applied to distributed generation. They are also lower than the rural and small-industry tariffs in many distribution concessions (https://portalrelatorios.aneel.gov.br/luznatarifa/basestarifas# access date 1 February 2024, B2 and B3 tariff categories).

Both the Financial LCC and LCOE for the OG model are higher than their equivalents for the DG model, but the significant decrease in the LCOE due to subsidies is not sufficient to close the gap between the LCOEs of the OG model and DG model.

Diesel-based generation in the OG setting has a higher Financial LCC than the biomass OG model; however, the LCOE of diesel-based generation is lower than the OG model LCOE because of the more advantageous subsidies. After accounting for external costs, the biomass OG model has the lowest Societal LCC, largely due to avoided subsidies for diesel-based generation. In other words, the subsidies necessary to reach the costs for consumers equivalent to the BaU LCOE in isolated grids would be less costly for society if biomass gasification was substituted for diesel-based generation. The GHG emissions avoided by the OG model, largely compensating for the emissions due to biomass transportation, are significantly higher than those of the DG model, in which the electricity substituted has a lower GHG intensity than the diesel-based generation in isolated grids. However, the impact of the GHG emission reductions in terms of the external costs is marginal compared to the avoided subsidies. The external cost due to the lack of adequate solid-residue disposal in the OG system also has less relevance.

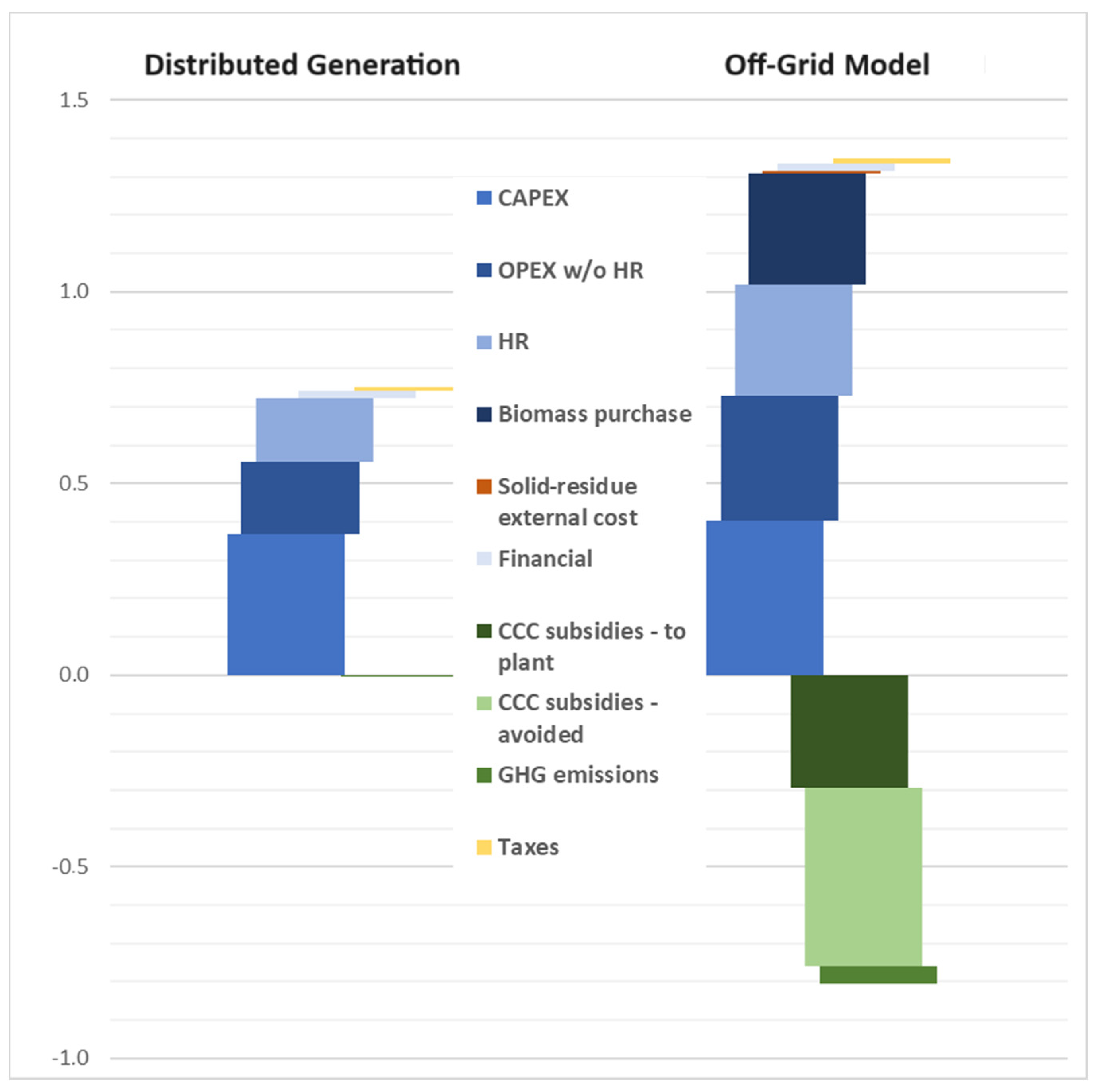

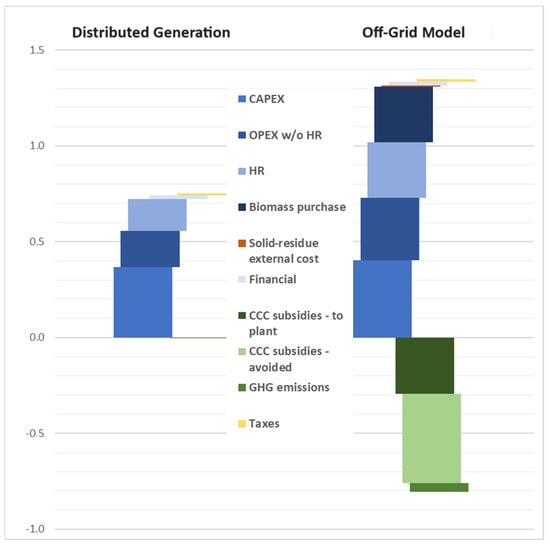

A breakdown of the Societal LCC into its main elements, presented in Figure 4 below, shows the relative participation of the Financial LCC—CAPEX (INV), OPEX (OPCosts, excluding biomass and HR costs); HR costs; financial costs (FINCosts)—biomass costs (FuelCosts), taxes; LCOEs (subsidies); and external costs (Others)—avoided subsidies, GHG emission costs, and solid-residue disposal costs.

Figure 4.

Societal LCC breakdown (left) for DG model and (right) for OG model.

The financial costs (FinCostsO include loan drawdowns and principal and interest repayments.

Taxes include corporate taxes levied on the result of the operation, as well as tax benefits based on depreciation and operational costs.

Elements of the Financial LCC are displayed in shades of blue, positive externalities in shades of green, negative externalities in red, and taxes in yellow.

The CAPEX (INV) is the most important cost for both models. In the OG model, the biomass purchase (FuelCost) and HR costs (included in OPCosts) combined represent the largest part of the OPEX, which represents the largest share of the total costs. These operational costs explain the much higher Financial LCC of the OG model.

3.2. Sensitivity Analysis

The parameters considered for the sensitivity analysis were chosen considering their participation in the relevant costs of the LCOE and Societal LCC.

Biomass purchase costs are an important sensitivity parameter because they are highly uncertain, and they represent a significant difference between the two models in terms of their cost structures.

The diesel price at year 0 affects the operational costs of the OG model and the cost of diesel generation; therefore, it directly affects the subsidies for diesel-based generation and the avoided subsidies for the OG model. Due to the high uncertainties and volatility of the prices over the lifetime of the project, the diesel price is supposed to be constant on nominal terms, and the sensitivity analysis considered the constant-price variation.

The energy efficiency of the system affects the overall performance of the plant; this parameter is used instead of varying several other parameters that are always proportionally related to the electricity production per ton of biomass, such as the moisture content, LHV, and biomass composition.

HR costs represent a large share of the OPEX and are highly relevant, as they affect the operation and maintenance of the power plant.

GHG emission pricing affects the external costs only.

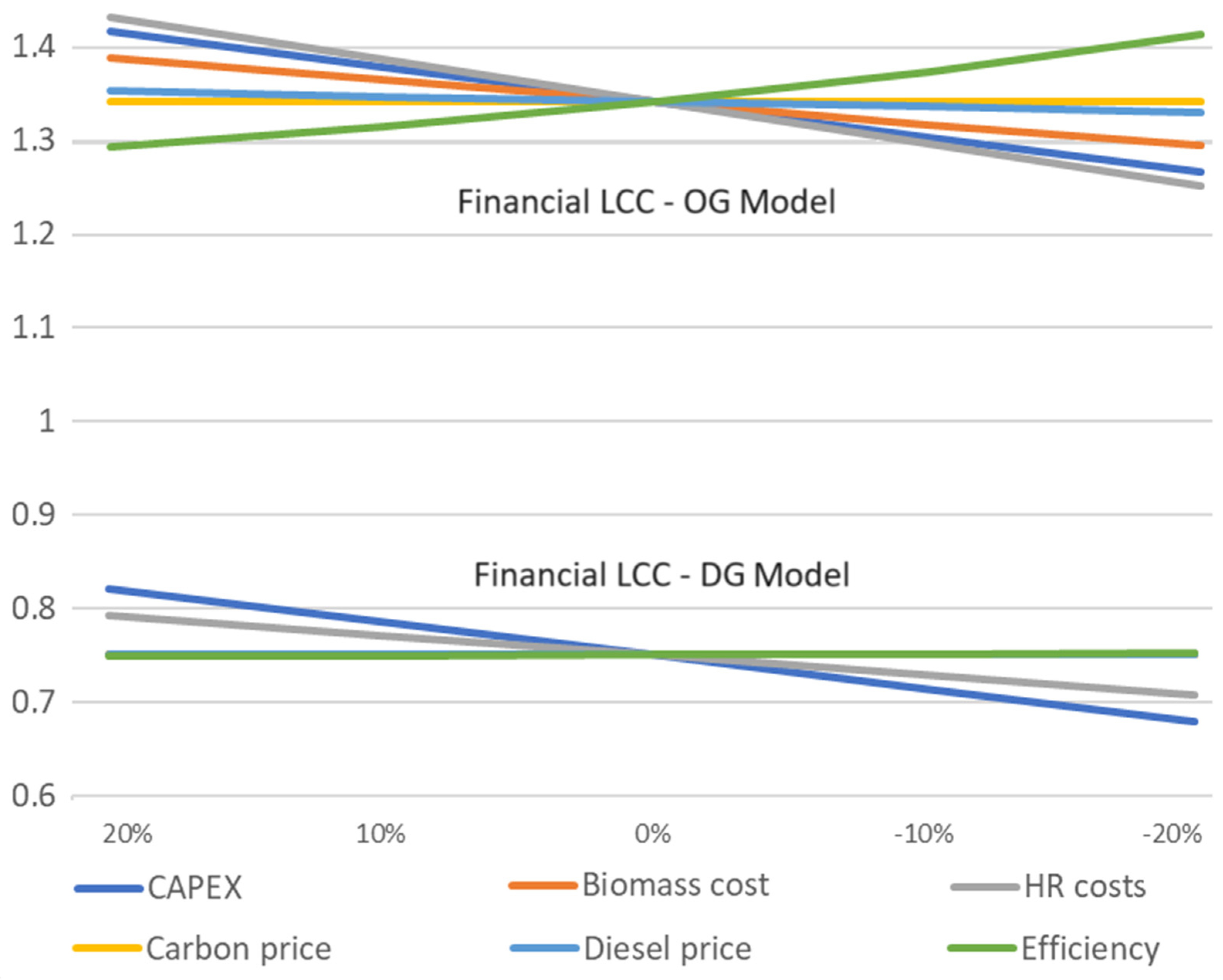

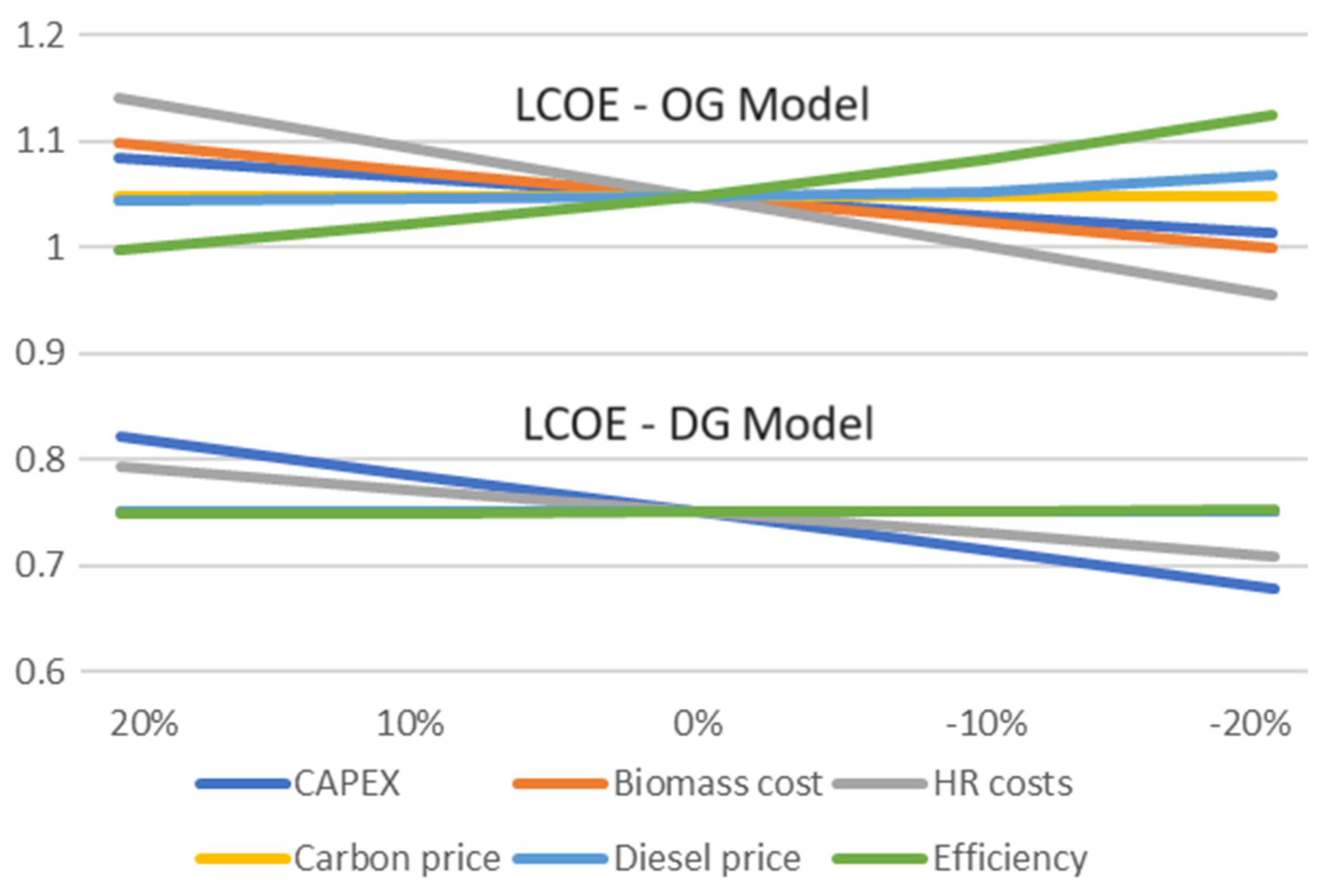

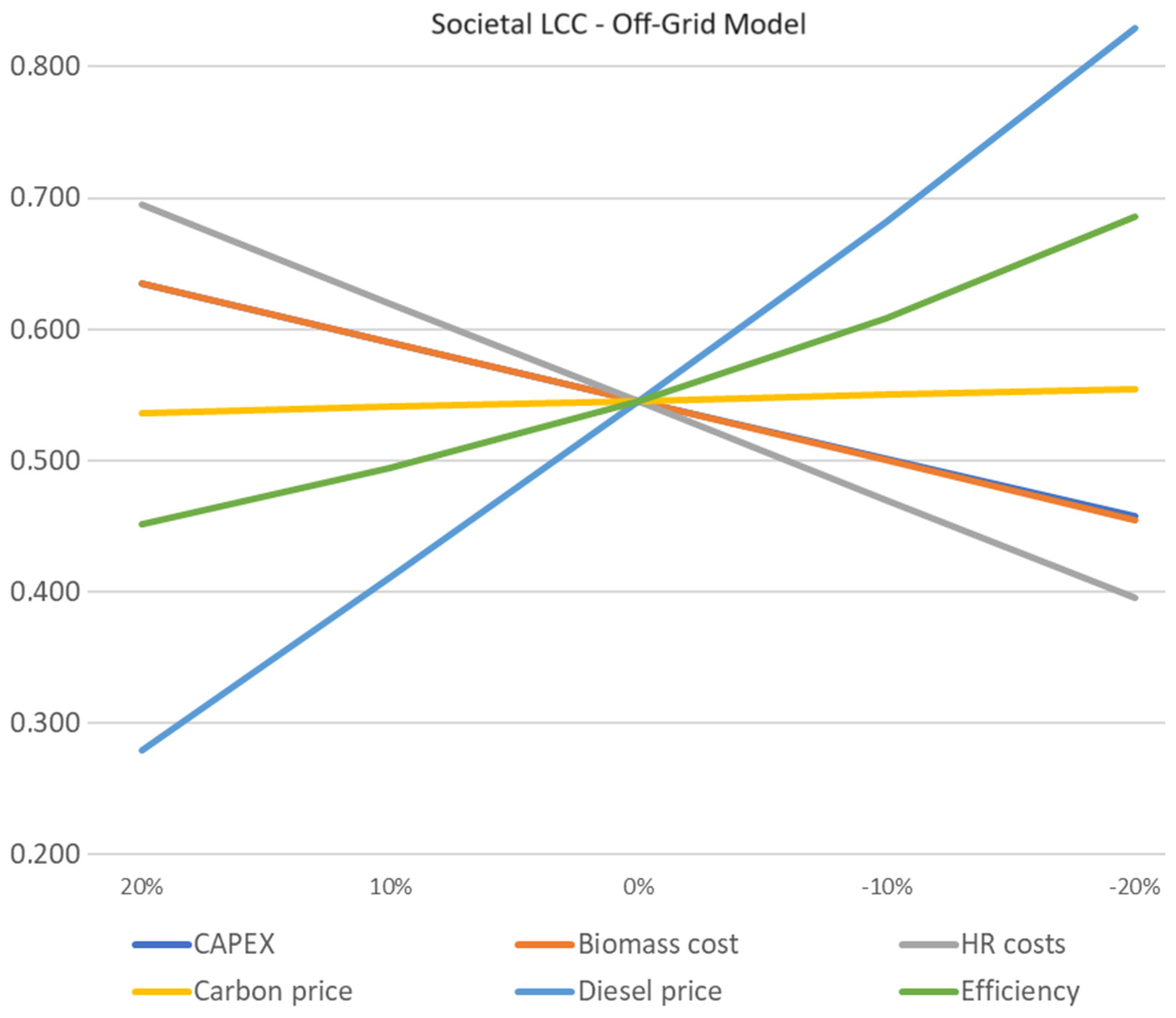

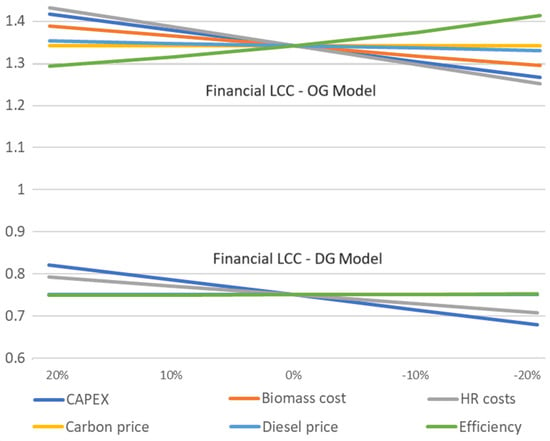

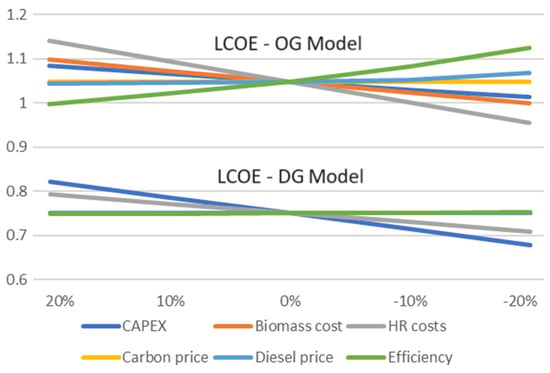

Figure 5, Figure 6 and Figure 7 below show the effects of the selected factors on the DG and OG models’ Financial LCC and LCOE and on the OG Societal LCC.

Figure 5.

Effects of selected cost factor variations on Financial LCCs of both models.

Figure 6.

Effect of selected cost factor variations on LCOEs of both models.

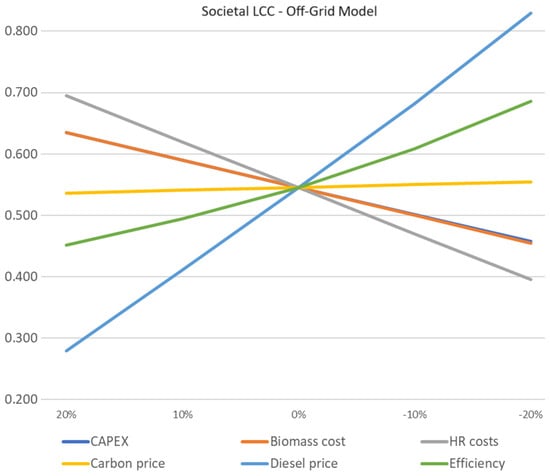

Figure 7.

Effects of selected cost factor variations on Societal LCC in the OG model.

Figure 5 shows that the gap between the DG and OG models’ Financial LCCs is significantly higher than the variations in each LCC to the sensitivity parameters. Figure 6 shows that this gap was narrowed once subsidies were applied to the OG model; however, this did not lead to an equivalent LCC under individual sensitivity parameter variations of ±20%.

In the DG model, CAPEX variation had the highest impact on the Financial LCC. In the OG model, HR costs had a slightly higher impact than the CAPEX variation.

Efficiency had a limited impact on the DG model LCC, whereas it had a relevant impact on the OG model LCC because it mostly affected the quantity of biomass necessary to attend to the electricity demand, driving the costs for the OG model but not for the DG model. Similarly, the biomass cost impacted only the OG model LCC.

Finally, if there is a cumulative increase in the CAPEX by 50%, in the HR costs by 50%, and in the biomass costs by 100%, the Financial LCC of the DG case will be equal to 1.05 BRL/kWh, and that of the OG case will be equal to 1.99 BRL/kWh.

If carbon prices were included in the LCOEs of both models, then a price of 365.5 BRL/tonCO2eq would be needed to equalize both prices.

The behavior of the Societal LCC shows trends similar to those of the Financial LCC in terms of the impact of the CAPEX, HR, and biomass costs and efficiency. The carbon price had a limited impact, which was expected considering its limited contribution to the overall LCC. Diesel prices had the most significant impact on the Societal LCC; indeed, diesel prices directly affected the subsidies to diesel-based generators. Lower diesel prices reduce the external costs to society of diesel-based generation and consequently reduce the positive externalities of biomass gasification in terms of subsidy reduction.

4. Discussion

This discussion on the results of this work addresses both the quantitative results and qualitative aspects of the analysis. On the quantitative side, the LCC calculated is compared to those of previous studies on the economic performances of similar projects, and the qualitative factors leading to differences in the costs between the BMs and their sensitivities to some of these factors are highlighted and analyzed. Then, on the qualitative side, the relationship between the business models, regulation, and barriers to the development of biomass gasification for decentralized electricity generation is discussed.

A synthesis of the costs of electricity generation by small-scale biomass gasification presented in the literature reviewed for this study is presented in Table 4 below.

Table 4.

Synthesis of LCC and LCOE data for biomass gasification with small-scale electricity generation in the literature.

Wide variations in terms of the costs of the electricity generation in small-scale biomass gasification projects were observed in the literature. Differences in feedstock costs, CAPEX values, HR costs, efficiencies of processes, and financial assumptions explain most of these differences. The results of this study are comparable to those of most of the previous studies analyzed, although both higher and lower results were found.

Cost study comparisons must be made while keeping in mind that qualitative assumptions for the system affect both the CAPEX and OPEX, the performance, the environmental outcomes, and the safety of the system. Although the better quality of the equipment and strict operational procedures tend to increase the investment and operational costs, respectively, they contribute to lower unplanned maintenance costs and tend to improve the overall performance of the system, with a positive outcome for energy production. Environmental outcomes and related external costs may also be affected by equipment choices, especially emissions and water treatment systems, which also affect both the CAPEX and OPEX. This study did not focus on these considerations but assumed that good quality of the equipment and O&M procedures guaranteed satisfactory efficiency, environmental impacts, and operational safety.

The comparative analysis of the extended Business Model Canvas of the two models studied showed that, although the same technical setup was considered, differences in most of the elements of the BM Canvas led to relevant differences between the three types of LCCs evaluated. The sensitivity analysis also showed that the business models themselves have more impact on the LCOEs than technical and environmental factors.

Differences in the Financial LCCs and LCOEs between the two models are mostly explained by the origins of the biomasses used in the processes and the energy demand patterns. Biomass purchase costs make a significant contribution to the OG model’s LCC, whereas the DG model uses residual biomass produced by the consumer, resulting in no cost. Alternative opportunities to use the biomass could be considered in further studies. The energy demand patterns imply that, in the DG model, the power plant is used for 11 h daily, whereas the OG model operates for 24 h. Biomass gasification system operation is complex not only because of the variety of processes involved and the high sensitivity of the system to operational parameters such as the biomass moisture and size, feeding rate, temperature reaction, and gas cleaning [60,61,64], but also because of the high risks of fire, explosion, and toxic emissions due to the high operating temperature, which must be mitigated by strict operational procedures [63]. Therefore, gasification systems require a large and well-trained team to avoid shutdowns or inefficient operations, and to guarantee their safety. This results in higher HR needs and costs, and therefore the different operating hours significantly impact the overall operational costs.

The outcomes of the Societal LCC are mostly due to the BaU scenarios for biomass use and electricity production. In the DG model, the electricity substituted was the Brazilian interconnected system mix, with a GHG intensity estimated at 0.1 kgCO2eq/kWh. In the OG model, the BaU electricity generation technology was diesel-based, with a GHG intensity estimated at 0.666 kgCO2eq/kWh. Both GHG intensities were calculated based on data from the EPE [102] and the IPCC methodology [103].

The financial LCC of OG gasification is lower than the diesel-based LCC; however, higher CCC subsidies for diesel-based generation result in a lower LCOE for the latter. In turn, the avoided subsidies for diesel-based generation is the most relevant externality affecting the Societal LCC of the OG model, regardless of the environmental aspects in the current context of low carbon prices and the absence of robust pricing methods for environmental externalities. The DG model does not generate similar positive external costs, except for less significant GHG emission reductions. Indeed, in the DG model, the BaU is the electricity mix from the national grid, with no direct subsidy and a low carbon intensity. External-cost reduction is therefore limited to the low difference in the GHG emissions per kilowatthour, with no external cost related to subsidy displacement.

The business models affected not only the LCC results but also their sensitivities to the cost factors. Efficiency had a limited impact on the DG model LCC, whereas it had a relevant impact on the OG model. Indeed, efficiency was correlated to the quantity of biomass needed to produce electricity, affecting the biomass costs, which represented a large part of the OPEX in the OG model, and affecting the non-HR OPEX values only slightly in both cases. The comparative analysis of the BM Canvas showed the dependence of the OG model on biomass suppliers, generating risks of increasing the LCOEs of the projects due to their sensitivities to biomass purchase prices. Additionally, biomass supply shortages have strong negative effects on the project’s financial performance. Establishing strong relationships with biomass suppliers is therefore crucial to reduce these risks.

GHG emission pricing had a marginal overall impact on the external costs. The sensitivity analysis, the objective of which was to evaluate the emission price that would substitute the subsidies granted to the OG model, estimated that, in the base case scenario, the minimum GHG emission price that would equalize the LCOEs is 365.5 BRL/ton CO2eq, which is much higher than the BRL 50 price originally considered as the current price in voluntary markets in Brazil. This shows that, currently, GHG emission reduction pricing is far from closing the gap between OG biomass gasification and the BaU or DG model.

The overall results of this BM comparison show that, from a purely economic point of view, DG models tend to have lower LCOEs, lower or close to the electricity tariffs applicable to rural consumers and small industries in most distribution concessions (https://portalrelatorios.aneel.gov.br/luznatarifa/basestarifas# access date 1 February 2024); therefore, they may be easier to exploit as a niche to leverage the development of residual biomass gasification. However, the prospect of reducing public spending in subsidies for isolated grids and reducing GHG emissions and the dependence on diesel in remote areas of the country would make the OG model a preferable option in terms of the overall costs for society. Diesel prices have a significant impact on this societal cost reduction, and their long-term evolution is subject to high uncertainties.

The geographical and regulatory contexts in which the projects are located have a relevant impact both on BMs and externalities. In some countries, such as India [15], residual biomass is usually burnt in open fields, as in the BaU scenario; therefore, externalities due to the resulting air pollution largely affect the externalities avoided by using the biomass for gasification. Similarly, the DG model implemented in countries with higher GHG intensities in the interconnected grid generate higher GHG emission reductions.

As mentioned earlier, BMs must comply with the regulation in force, and new BMs are usually developed based on the evolution of the regulation. The DG regulation issued in Brazil in 2012 allows consumers to produce electricity from renewable sources for their consumption, but they are not allowed to sell any excess electricity. However, a credit scheme allows them to decouple the production and consumption of electricity, bringing more flexibility and the possibility of accessing the grid electricity in periods in which the system is unavailable. In the OG model, the IPP does not sell electricity directly to consumers but rather to a distribution concessionary responsible for operating the grid and billing the consumers. On the one hand, this model reduces the counterpart risk, which is transferred to the distribution company, but, on the other hand, synergies are more difficult to exploit with local biomass suppliers and other consumers. Some case studies have evaluated the viability of BMs supporting local economic development by powering agricultural-product-processing plants using their biomass residues [33,34,36]. The LCOEs of such models are greatly reduced, closer to those of the DG model, however without the flexibility and back-up electricity supply allowed by the electricity credit scheme. In Brazil, such a BM is allowed; however, in this case, the sale of electricity to other consumers is not allowed either.

While, on the one hand, restricted within the regulatory framework, business models can be designed to address some barriers faced by gasification technology. In the OG model, the market barrier related to the biomass supply can be solved with adequate contracts and strong relationships with local farmers by including them as close stakeholders. Technical barriers affecting small-scale gasification can be partially addressed within the BM, mostly by contracting specialized O&M services, ideally from the equipment supplier itself, with potentially higher costs but also with a reduced risk of the high unavailability of the system in cases of inadequate operation.

Apart from adjustments to business models, restricted to the existing regulatory framework, policy support still appears to be necessary to foster the development of biomass gasification technology and is justified by its positive externalities.

The LCC modeling showed that the distributed generation by agro-industry factories’ residual biomasses through gasification is close to grid parity and significantly less costly than the off-grid model. Substituting diesel-based generation with residual biomass gasification in isolated grids in Brazil would generate more positive externalities for society in the form of avoided subsidies for diesel-based generation, along with positive environmental impacts. Additional aspects relevant to policymaking not considered in the Societal LCC include the socioeconomic and distributive aspects related to the additional revenues to local farmers, job creation, and enhanced economic activity. Reductions in diesel importations would also have a positive effect on the country’s commercial balance. As suggested by a UNDP report [111], these positive externalities can contribute to creating the willingness to support the development of off-grid residual biomass gasification systems as a substitution for diesel-based generators through public policies, adequate subsidies, and financial support programs, such as loans and tax rebates. As pointed out by Ghosh et al. [58], subsidies and other financial incentives should be coordinated with other types of policy instruments, aiming at enabling a larger national infrastructure manufacturing capacity and stimulating the development of adequate business models to better exploit the positive externalities, including the productive use of co-products to generate additional income and further positive externalities, such as described by Bhattacharyya [32].

Furthermore, biomass gasification is still subject to technological challenges, such as complexity, the lack of flexibility of the technology regarding different feedstocks [20,59,60], and the lack of qualified manpower for operation [54], contributing to high unavailability rates [64]. Policy actions should therefore consider these technological barriers, aim at increasing the reliability of biomass gasification systems and their adaptation to local biomasses, and generate the knowledge and local capacities to operate these systems (suggested, for example, in [89]) in coordinated action with the other support instruments already mentioned.

5. Conclusions

This work shows that different business models using the same technical setup—a small-scale power plant generating electricity from residual biomass gasification—had such different financial costs that the business models imported more than just the major parameters, such as investment costs and energy efficiency, into the life-cycle costs. The cost difference was mostly due to biomass purchases and human resources, which also were identified as directly related to the major barriers to the viability of biomass gasification projects.

Externalities, which are not priced but generate or avoid costs for stakeholders other than those directly involved, contribute to changes in the relative cost for society in favor of the off-grid model in the Brazilian context, due to higher GHG emission reductions and avoided subsidies for diesel-based generation.

If, on the one hand, the Societal LCC comparison constitutes an objective means of comparing technologies and business models to select the ones most beneficial for society, then, on the other hand, the qualitative analysis of the barriers to the implementation of new technologies show that factors other than costs can prevent the development of potentially beneficial technologies. Therefore, cost-efficient subsidies must be combined with policy instruments that target the barriers to achieving a sustainable transition to a more resilient energy system.

The main limitations of this work are related to the external costs and the applications of the methodology proposed.

In terms of the external costs, more detailed assessments of the environmental impacts of biomass gasification, and further evaluations of the corresponding monetary costs, are needed. The external costs of non-GHG air and water emissions, especially, have not been modeled, due to the high uncertainties in the quantification of these emissions and their pricing in the absence of an actual market or dominant valuation methodology. Externalities related to solid residues should also be further studied. Finally, the benefits of electricity production decentralization in the external costs of the DG model were not considered in this study.

Biochar production, sales, and environmental impacts were excluded from this study. Indeed, most gasification systems do not generate biochar but rather optimize the production of syngas. Sales of biochar would, however, have potentially similar and relevant outcomes in both models’ Financial and Societal LCCs.

Regarding the applications of the methodology, the case studies proposed in this work are limited to the business models currently allowed in the context of the Brazilian regulation. The insights of this work could therefore be extended if other business models and other countries with different BaU scenarios in terms of electricity generation and residual biomass handling were studied.

Future studies should address the limitations of this work whenever possible. Applying the methodology to other countries, with different electricity mixes and alternative uses of biomasses, as well as different regulations and rural electrification contexts, would allow for variations in BaU electricity production, BaU residual biomass management, and business models. Different technological settings, for example, considering the SOFC as the electricity generation technology, could also be used.

Supplementary Materials

The following supporting information can be downloaded at https://www.mdpi.com/article/10.3390/en17081868/s1; LCC calculation tool: LCC tool.xls.

Author Contributions

Conceptualization, L.D. and A.O.P.J.; methodology, L.D. and A.O.P.J.; validation, A.O.P.J.; formal analysis, L.D.; investigation, L.D.; resources, A.O.P.J.; data curation, L.D.; writing—original draft preparation, L.D.; writing—review and editing, L.D. and A.O.P.J.; visualization, L.D. and A.O.P.J.; supervision, A.O.P.J.; project administration, A.O.P.J.; funding acquisition, A.O.P.J. All authors have read and agreed to the published version of the manuscript.

Funding

The authors are pursuing their research work with the support of CAPES (Coordination for the Improvement of Higher Education Personnel), the CNPq (National Council for Scientific and Technological Development, grant number 303432/2022-5), and the FAPERJ (Fundação Carlos Chagas Filho de Amparo à Pesquisa do Estado do Rio de Janeiro, grant number E-26/202.310/2022).

Data Availability Statement

The original contributions presented in the study are included in the article, further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A

Table A1.

CAPEX values.

Table A1.

CAPEX values.

| CAPEX—All Values in BRL | DG | OG | Comments |

|---|---|---|---|

| Gasification equipment | 2,668,000 | 2,668,000 | |

| Pre-treatment system | 184,000 | 184,000 | Reference cost: BRL 400/kW |

| Drying system | 276,000 | 276,000 | Reference cost: BRL 600/kW |

| Gasification reactor | 1,840,000 | 1,840,000 | Reference cost: BRL 4000/kW |

| Gas-cleaning system | 368,000 | 368,000 | Reference cost: BRL 800/kW |

| ICE | 828,000 | 828,000 | Reference cost: BRL 1800/kW |

| Balance of plant | 1,223,600 | 1,223,600 | 35% of the total equipment cost, an average of 25%, and 45% of the references used |

| Equipment transportation | 50,000 | 200,000 | Higher costs are due to the remoteness of the isolated grid |

| Engineering | 400,000 | 400,000 | Engineering costs based on commercial offer from W2E Energia |

| Administrative costs | 100,000 | 300,000 | Evaluation based on experience |

| TOTAL—BRL | 5,269,600 | 5,619,600 | |

| TOTAL—BRL/kW | 11,456 | 12,217 |

All reference costs for the gasification equipment are based on [45,48] and a commercial proposal for the PYROFLEX 500 gasification system from W2E Energia received in February 2023.

Table A2.

OPEX values.

Table A2.

OPEX values.

| OPEX—All Values in BRL | DG | OG | Comments |

|---|---|---|---|

| Energy needs of the system | Considered in the energy balance | ||

| FIXED OPEX | 414,640 | 774,000 | |

| Human resources | 264,000 | 576,000 | Four operators for 8 h operation—adjusted to daily operation hours. Average monthly salary: BRL 4000 |

| Consumables | 46,000 | 46,000 | 100 BRL/kW |

| Equipment maintenance | 92,000 | 92,000 | 200 BRL/kW |

| Administration | 12,640 | 60,000 | Higher costs are due to regulation/PPA management |

| VARIABLE OPEX | 26,688 | 419,197 | |

| Consumables | 17,546 | 18,133 | 0.01 BRL/kWh |

| Solid-residue handling | 9142 | - | Landfill fee: 100 BRL/ton |

| Biomass purchases | 0 | 304,760 | 100 BRL/ton |

| Biomass transportation | 0 | 96,304 | Based on diesel consumption for biomass transportation |

| TOTAL | 441,328 | 1,193,197 | Total value per year |

Table A3.

GHG emissions.

Table A3.

GHG emissions.

| Values in kgCO2eq/kWh | DG | OG | Sources and Comments |

|---|---|---|---|

| Agricultural production | This stage is out of the scope of this study | ||

| Biomass transportation | 0 | 0.02 | Calculated considering 2 tons of biomass per truck, 2 km/L of diesel consumption of truck, 10 km transportation (20 km both ways), IPCC [104] Emission Factor of Diesel of 0.074 kgCO2e/MJ, 595 kWh produced per ton of biomass |

| Construction phase | 0.027 | Calculated based on [41] | |

| Gasification process and electricity production | 0.0204 | Calculated based on [40]: non-biogenic emissions from gasification and power production processes | |

| Water treatment | 0.0068 | Calculated based on the methodology in [41], which evaluated CH4 emissions from wastewater treatment and the use of 9.8 L of water per kWh [102] | |

| Avoided emissions from BaU electricity | 0.1 | 0.666 | Calculated based on data from [103] |

References

- IPCC. Sixth Assessment Report: Synthesis Report. Intergovernmental Panel of Climate Change. 2022. Available online: https://www.ipcc.ch/report/ar6/wg3/ (accessed on 20 January 2023).

- Baasch, S. Energy transition with biomass residues and waste: Regional-scale potential and conflicts. A case study from North Hesse, Germany. J. Environ. Policy Plan. 2021, 23, 243–255. [Google Scholar] [CrossRef]

- Lonergan, K.E.; Suter, N.; Sansavini, G. Energy systems modeling for just transitions. Energy Policy 2023, 183, 113791. [Google Scholar] [CrossRef]

- Kilinc-Ata, N.; Proskuryakova, L.N. Empirical analysis of the Russian power industry’s transition to sustainability. Util. Policy 2023, 82, 101586. [Google Scholar] [CrossRef]

- Cordeiro, N.K.; Cardoso, K.P.S.; Mata, T.C.; Barbosa, J.A.; Gonçalves, A.C., Jr. Gestão de Resíduos Agrícolas como forma de redução dos impactos ambientais. Rev. Ciências Ambient. 2020, 14, 2. [Google Scholar] [CrossRef]

- Basu, P. Biomass Gasification and Pyrolysis Practical Design and Theory; Elsevier: Oxford, UK; Academic Press: Cambridge, MA, USA, 2010; Available online: http://refhub.elsevier.com/S0306-2619(17)31094-2/h0005 (accessed on 10 June 2023).

- Benedetti, V.; Patuzzi, F.; Baratieri, M. Characterization of char from biomass gasification and its similarities with activated carbon in adsorption applications. Appl. Energy 2018, 227, 92–99. [Google Scholar] [CrossRef]

- Faaij, A.; van Ree, R.; Waldheim, L.; Olsson, E.; Oudhuis, A.; van Wijk, A.; Daey-Ouwens, C.; Turkenburg, W. Gasification of biomass wastes and residues for electricity production. Biomass Bioenergy 1997, 12, 387–407. [Google Scholar] [CrossRef]

- Elsner, W.; Wysocki, M.; Niegodajew, P.; Borecki, R. Experimental and economic study of small-scale CHP installation equipped with downdraft gasifier and internal combustion engine. Appl. Energy 2017, 202, 213–227. [Google Scholar] [CrossRef]

- Ferreira, E.T.d.F.; Balestieri, J.A.P. Comparative analysis of waste-to-energy alternatives for a low-capacity power plant in Brazil. Waste Manag. Res. 2018, 36, 247–258. [Google Scholar] [CrossRef]

- Klavins, M.; Bisters, V.; Burlakovs, J. Small Scale Gasification Application and Perspectives in Circular Economy. Environ. Clim. Technol. 2018, 22, 42–54. [Google Scholar] [CrossRef]

- Priall, O.; Gogulancea, V.; Brandoni, C.; Hewitt, N.; Johnston, C.; Onofrei, G.; Huang, Y. Modelling and experimental investigation of small-scale gasification CHP units for enhancing the use of local biowaste. Waste Manag. 2021, 136, 174–183. [Google Scholar] [CrossRef]

- Belgiorno, V.; De Feo, G.; Della Rocca, C.; Napoli, R.M.A. Energy from gasification of solid wastes. Waste Manag. 2003, 23, 1–15. [Google Scholar] [CrossRef] [PubMed]

- Khoo, H.H. Life cycle impact assessment of various waste conversion technologies. Waste Manag. 2009, 29, 1892–1900. [Google Scholar] [CrossRef] [PubMed]

- Bisht, A.S.; Thakur, N.S. Small scale biomass gasification plants for electricity generation in India: Resources, installation, technical aspects, sustainability criteria policy. Renew. Energy Focus 2019, 28, 112–126. [Google Scholar] [CrossRef]

- Dowaki, K.; Mori, S.; Fukushima, C.; Asai, N.A. Comprehensive Economic Analysis of Biomass Gasification Systems. Electr. Eng. Jpn. 2005, 153, 52–63. [Google Scholar] [CrossRef]

- González, C.A.D.; Pacheco Sandoval, L. Sustainability aspects of biomass gasification systems for small power generation. Renew. Sustain. Energy Rev. 2020, 134, 110180. [Google Scholar] [CrossRef]

- You, S.; Tong, H.; Armin-Hoiland, J.; Tong, Y.W.; Wang, C.-H. Techno-economic and greenhouse gas savings assessment of decentralized biomass gasification for electrifying the rural areas of Indonesia. Appl. Energy 2017, 208, 495–510. [Google Scholar] [CrossRef]

- Aberilla, J.M.; Gallego-Schmid, A.; Azapagic, A. Environmental sustainability of small-scale biomass power technologies for agricultural communities in developing countries. Renew. Energy 2019, 141, 493–506. [Google Scholar] [CrossRef]

- Sansaniwal, S.K.; Rosen, M.A.; Tyagi, S.K. Global challenges in the sustainable development of biomass gasification: An overview. Renew. Sustain. Energy Rev. 2017, 80, 23–43. [Google Scholar] [CrossRef]

- United Nations. Financing for Sustainable Development Report 2023—Financing Sustainable Transformations. 2023. Available online: https://desapublications.un.org/publications/financing-sustainable-development-report-2023 (accessed on 10 October 2023).

- Callan, S.; Thomas, J. Environmental Economics: Theory, Policy and Applications; South Western College: Chula Vista, CA, USA, 2010. [Google Scholar]

- Zott, C.; Amit, R.; Massa, L. The Business Model: Recent Developments and Future Research. J. Manag. 2011, 37, 1019–1042. [Google Scholar] [CrossRef]

- Bolton, R.; Foxon, T.J. A socio-technical perspective on low carbon investment challenges—Insights for UK energy policy. Environ. Innov. Soc. Transit. 2015, 14, 165–181. [Google Scholar] [CrossRef]

- Boons, F.; Ludeke-Freund, F. Business Models for Sustainable Innovation: State of the Art and Steps towards a Research Agenda. J. Clean. Prod. 2013, 45, 9–19. [Google Scholar] [CrossRef]

- Antikainen, M.; Valkokari, K. A framework for sustainable circular business model innovation. Technol. Innov. Manag. Rev. 2016, 6, 5–12. [Google Scholar] [CrossRef]

- Otoo, M.; Gebrezgabher, S.; Drechsel, P.; Rao, K.C. Defining and Analyzing RRR Business Cases and Models. In Resource Recovery from Waste—Business Models for Energy, Nutrients and Water Reuse in Low and Middle-Income Countries; Drechsel, P., Ed.; Routledge: New York, NY, USA, 2018. [Google Scholar]

- Freitas, K.T.; Souza, R.C.R.; Seye, O.; Santos, E.C.S.; Xavier, D.J.C.; Bacellar, A.A. Custo de geração de energia elétrica em comunidade isolada do Amazonas: Estudo preliminar do projeto NERAM. Rev. Bras. De Energ. 2006, 12, 1. Available online: https://www.cdeam.ufam.edu.br/images/Publicacoes_e_artigos/2006/2006_Art_5_CDEAM.pdf (accessed on 30 September 2023).

- Ince, P.J.; Bilek, E.M.; Dietenberger, M.A. Modeling Integrated Biomass Gasification Business Concepts. Research Paper FPL-RP-660; U.S. Department of Agriculture, Forest Service, Forest Products Laboratory: Madison, WI, USA, 2011; 36p. Available online: https://www.fpl.fs.usda.gov/documnts/fplrp/fpl_rp660.pdf (accessed on 25 November 2022).

- Yagi, K.; Nakata, T. Economic analysis on small-scale forest biomass gasification considering geographical resources distribution and technical characteristics. Biomass Bioenergy 2011, 35, 2883–2892. [Google Scholar] [CrossRef]

- Buchholz, T.; Da Silva, I.; Furtado, J. Power from wood gasifiers in Uganda: A 250 kW and 10 kW case study. Proc. Inst. Civ. Eng. Energy 2012, 165, 181–196. [Google Scholar] [CrossRef]

- Bhattacharyya, S.C. Viability of off-grid electricity supply using rice husk: A case study from South Asia. Biomass Bioenergy 2014, 68, 44–54. [Google Scholar] [CrossRef]

- Pode, R.; Diouf, B.; Pode, G. Sustainable rural electrification using rice husk biomass energy: A case study of Cambodia. Renew. Sustain. Energy Rev. 2015, 44, 530–542. [Google Scholar] [CrossRef]

- Field, J.L.; Tanger, P.; Shackley, S.J.; Haefele, S.M. Agricultural residue gasification for low-cost, low-carbon decentralized power: An empirical case study in Cambodia. Appl. Energy 2016, 177, 612–624. [Google Scholar] [CrossRef]

- Naqvi, M.; Yan, J.; Dahlquist, E.; Naqvi, S.R. Waste Biomass Gasification Based off-grid Electricity Generation: A Case Study in Pakistan. Energy Procedia 2016, 103, 406–412. [Google Scholar] [CrossRef]

- Pode, R.; Pode, G.; Diouf, B. Solution to sustainable rural electrification in Myanmar. Renew. Sustain. Energy Rev. 2016, 59, 107–59118. [Google Scholar] [CrossRef]

- Arranz-Piera, P.; Kemausuor, F.; Darkwah, L.; Edjekumhene, I.; Cortes, J.; Velo, E. Mini-grid electricity service based on local agricultural residues: Feasibility study in rural Ghana. Energy 2018, 153, 443–454. [Google Scholar] [CrossRef]

- Gojiya, A.; Deb, D.; Iyer, K.K.R. Feasibility study of power generation from agricultural residue in comparison with soil incorporation of residue. Renew. Energy 2018, 134, 416–425. [Google Scholar] [CrossRef]

- Pérez, J.F.; Osorio, L.F.; Aguledo, A.F. A technical-economic analysis of wood gasification for decentralized power generation in colombian forest cores. Int. J. Renew. Energy Res. 2018, 8, 1071–1084. [Google Scholar] [CrossRef]

- Singh, A.; Basak, P. Conceptualization and techno-economic evaluation of microgrid based on PV/Biomass in Indian scenario. J. Clean. Prod. 2021, 317, 128378. [Google Scholar] [CrossRef]

- Yang, Q.; Zhou, H.; Zhang, X.; Nielsen, C.P.; Li, J.; Lu, X.; Yanga, H.; Chen, H. Hybrid life-cycle assessment for energy consumption and greenhouse gas emissions of a typical biomass gasification power plant in China. J. Clean. Prod. 2018, 205, 661–671. [Google Scholar] [CrossRef]

- Naqvi, M.; Yan, J.; Dahlquist, E.; Naqvi, S.R. Off-grid electricity generation using mixed biomass compost: A scenario-based study with sensitivity analysis. Appl. Energy 2017, 201, 363–370. [Google Scholar] [CrossRef]

- Cardoso, J.S.; Silva, V.; Eusébio, D.; Lima Azevedo, I.; Tarelho, L.A.C. Techno-economic analysis of forest biomass blends gasification for small-scale power production facilities in the Azores. Fuel 2020, 279, 118552. [Google Scholar] [CrossRef]

- Copa, J.R.; Tuna, C.E.; Silveira, J.L.; Boloy, R.A.M.; Brito, P.; Silva, V.; Cardoso, J.; Eusébio, D. Techno-Economic Assessment of the Use of Syngas Generated from Biomass to Feed an Internal Combustion Engine. Energies 2020, 13, 3097. [Google Scholar] [CrossRef]

- Indrawan, N.; Simkins, B.; Kumar, A.; Huhnke, R.L. Economics of Distributed Power Generation via Gasification of Biomass and Municipal Solid Waste. Energies 2020, 13, 3703. [Google Scholar] [CrossRef]

- Naqvi, S.R.; Naqvi, M.; Ammar Taqvi, S.A.; Iqbal, F.; Inayat, A.; Khoja, A.H.; Mehran, M.T.; Ayoub, M.; Shahbaz, M.; Saidina Amin, N.A. Agro-industrial residue Gasification feasibility in Captive Power Plants: A South-Asian Case Study. Energy 2020, 214, 118952. [Google Scholar] [CrossRef]

- Susanto, H.; Suria, T.; Pranolo, S.H. Economic analysis of biomass gasification for generating electricity in rural areas in Indonesia. IOP Conf. Ser. Mater. Sci. Eng. 2018, 334, 012012. [Google Scholar] [CrossRef]

- Colantoni, A.; Villarini, M.; Monarca, D.; Carlini, M.; Mosconi, E.M.; Bocci, E.; Hamedani, S.R. Economic analysis and risk assessment of biomass gasification CHP systems of different sizes through Monte Carlo simulation. Energy Rep. 2021, 7, 1954–1961. [Google Scholar] [CrossRef]

- Qamar, M.A.; Javed, A.; Liaquat, R.; Hassan, M. Techno-economic modeling of biomass gasification plants for small industries in Pakistan. Biomass Convers. Biorefin. 2021, 13, 8999–9009. [Google Scholar] [CrossRef]

- Barry, F.; Sawadogo, M.; Ouédraogo, I.W.; Bologo/Traoré, M.; Dogot, T. Geographical and economic assessment of feedstock availability for biomass gasification in Burkina Faso. Energy Convers. Manag. X 2022, 13, 100163. [Google Scholar] [CrossRef]

- Dafiqurrohman, H.; Safitri, K.A.; Setyawan, M.I.B.; Surjosatyo, A.; Aziz, M. Gasification of rice wastes toward green and sustainable energy production: A review. J. Clean. Prod. 2022, 366, 132926. [Google Scholar] [CrossRef]

- Odoi-Yorke, F.; Osei, L.K.; Gyamfi, E.; Adaramola, M.S. Assessment of crop residues for off-grid rural electrification options in Ghana. Sci. Afr. 2022, 18, e01435. [Google Scholar] [CrossRef]

- Balcioglu, G.; Jeswani, H.K.; Azapa, A. Energy from forest residues in Turkey: An environmental and economic life cycle assessment of different technologies. Sci. Total Environ. 2023, 874, 162316. [Google Scholar] [CrossRef] [PubMed]

- Teixeira Coelho, S.; Gómez, M.; La Rovere, E. Biomass Residues as Energy Source to Improve Energy Access and Local Economic Activity in Low HDI Regions of Brazil and Colombia (BREA). Glob. Netw. Energy Sustain. Dev. 2015. [CrossRef]

- Abouemara, K.; Shahbaz, M.; Mckay, G.; Al-Ansari, T. The review of power generation from integrated biomass gasification and solid oxide fuel cells: Current status and future directions. Fuel 2024, 360, 130511. [Google Scholar] [CrossRef]